tax credit survey ssn

Becaue the questions asked on that survey are very private and frankly offensive. From the research Ive done its apparently used to see if I would gain the employer a tax credit working for them but I am very hesitant of providing them my SSN without having a job offer.

Wotc Questions Why Is My Ss And Date Of Birth Required On Wotc Form Cost Management Services Work Opportunity Tax Credits Experts

Employers can verify citizenship through a tax credit survey.

. In this light and even if it might cost applicants the employment opportunity increasingly job searching counselors recommend that applicants write SSN available upon job offer in that space. However some companies go on mass hiring sprees targeting certain populations under these survey to take advantage of the tax credits. You cant claim more than.

Employer tax credit screening ssn. Nearly half of parents who used to get the checks now say they cant afford enough food to feed their families according to a May survey of 500 parents from Parents Together Action a nonprofit. The company and their website is legit.

Applicants Are Increasingly Unhappy About Having to Supply Their SSN Increasingly applicants are objecting to handing over their social security number automatically. At CMS as Work Opportunity Tax Credit WOTC experts and service providers since 1997 we receive a lot of questions via our website. 6272016 file 1003.

Socialsecuritynumber Youtube Youre gonna need it. Its called WOTC work opportunity tax credits. However some companies go on mass hiring sprees targeting certain populations under these survey to take advantage of the tax credits.

Tax credit survey ssn Thursday June 2 2022 Edit. Our team has 60 years of combined domain knowledge and development of industry best practices for maximum tax credit generation. Eligible applicants can now apply through the Department of Revenue Service portal by clicking on 2022 CT Child Tax Rebate Applications must be submitted by July 31.

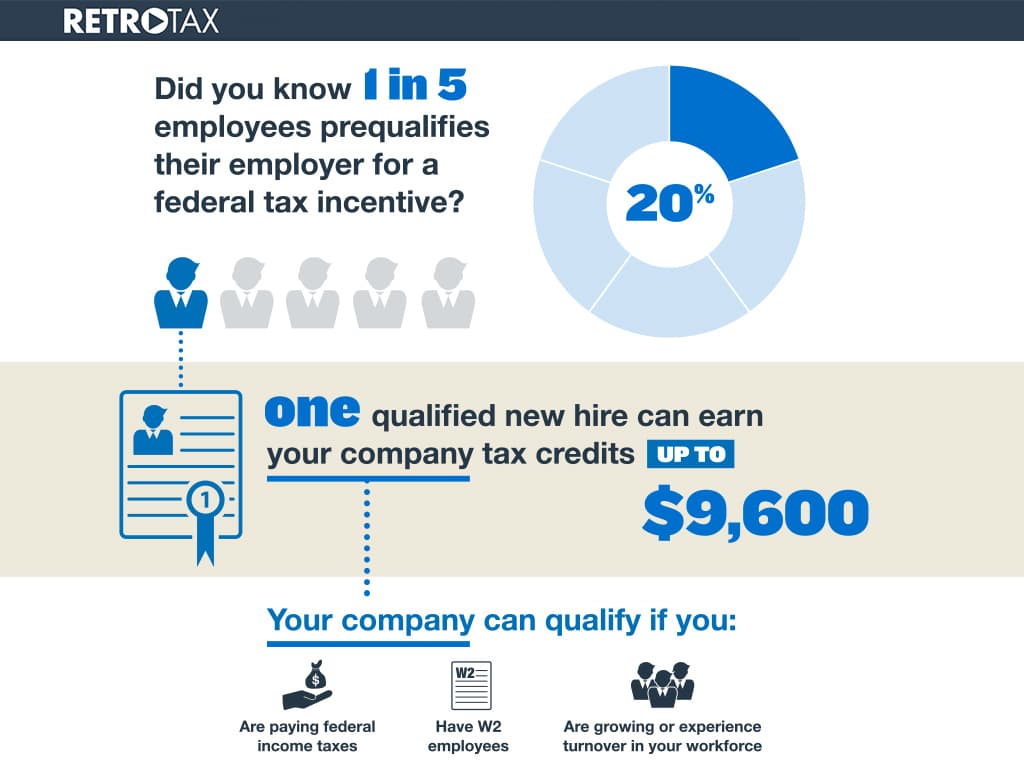

As of 2020 the tax credit can save employers up to 9600 per employee with no limit on the number of employees hired from targeted groups. The Work Opportunity Tax Credit is a federal tax credit available to employers who hire and retain qualified veterans and other individuals from target groups that historically have faced barriers in securing employment. By creating economic opportunities this program also helps lessen the burden on other government assistance programs.

The employer who can apply for the tax credit incentives then performs a tax credit survey. Employers can verify citizenship through a tax credit survey. Tax credit questionnaire ssn.

A tax credit survey checks to see if the quality assurance service technical equipment including software systems databases and analytics works properly. For example macys adds a tax credit survey to its application form to identify applicants who if hired qualify the company for the work opportunity tax credit. These surveys are for HR purposes and also to determine if the company is eligible for a tax creditdeduction.

Find answers to Do you have to fill out Work Opportunity Tax Credit program by ADP. Employers may ask you certain WOTC screening questions to determine if they are eligible to. Californias electronic wotc ewotc application process is a paperless alternative to the original wotc application process which requires employers to mail the irs form 8850 and department of labor dol individual characteristics form icf 9061 and any.

The WOTC is available for wages paid to certain individuals who begin work on or before December 31 2025. If they put in between 120 and 400 hours your credit is 16 percent. Annual tax performance report must be filed by may 31st of the following year.

Applications opened on June 1 and families that are eligible for the credit are set to get a maximum rebate of 250 which is capped at three children for a total of 750. Internal data must be verified in order to ensure accurate data when filling out tax credit surveys. The answers are not supposed to give preference to applicants.

All groups and messages. The Work Opportunity Tax Credit or WOTC is a general business credit provided under section 51 of the Internal Revenue Code Code that is jointly administered by the Internal Revenue Service IRS and the Department of Labor DOL. Let me ask you I promise not to do anything bad with your SS want to post it on CD we know the answer already.

Big companies want the tax credit and it might be a determining factor in selecting one applicant over another. Its a required field on the 2nd stage of an application before doing an interview. In the case of the above question the sender did not provide their email address so we were unable to reply directly to them.

By screening hiring and retaining WOTC qualified employees your business may receive a federal tax credit ranging from 1500 to 9600 per qualified individual based on the certified target group. Please complete the attached form by following the instructions provided. In FY 2018 we.

It also says that the employer is encouraged to hire individuals who are facing barriers to employment. As its a tax credit the amount comes directly off your taxes rather than reducing taxable income.

Self Employment Ledger Forms Beautiful Self Employment Ledger Template Excel Free Download Being A Landlord Self Employment Self

Retrotax Tax Credit Administration Jazzhr Marketplace

Is Survey Engine Tax Credit Co Safe Mcnally Institute

Physician Referral Form Template Fresh Medical Referral Form 8 Free Documents In Word Pdf Certificate Templates Templates Referrals

Child Tax Credit Or Ctc A Credit To Lift Families Out Of Poverty

What Is A Tax Credit Screening When Applying For A Job Welp Magazine

Asking For Social Security Numbers On Job Applications Goodhire

Work Opportunity Tax Credit What Is Wotc Adp

Understanding Taxes Earned Income Credit

Tax Filing Season Kicks Off Here S How To Get A Faster Refund

Physician Referral Form Template Fresh Medical Referral Form 8 Free Documents In Word Pdf Certificate Templates Templates Referrals

W 11 Form Completed How I Successfully Organized My Very Own W 11 Form Completed Form Example Job Application Template Tax Forms

Blue Payslip Design 1 Digital Only Copy Year Of Dates Document Templates Templates

Taxes Time Is Running Out To Claim Old 2018 Tax Refunds

Understanding Taxes Earned Income Credit