jersey city property tax assessment

Jersey City Hall 280 Grove Street Room 116. The median property tax in New.

Property Tax In New Jersey New Jersey League Of Municipalities

26 May 2021.

. The assessed value is determined by the Tax Assessor. Ocean City Tax Assessor. Official records of the Jersey County Supervisor of Assessments and the Jersey.

Such As Deeds Liens Property Tax More. Jersey City establishes tax levies all within the states statutory rules. Our assessments index provides users with detailed.

City Hall 280 Grove Street Room 116 Jersey City NJ 07302 Tel. Property tax assessment in New Jersey. In New Jersey property taxes are calculated using the formula.

Jersey City NJ 07307. Online Inquiry Payment. 7 E 14th St 825 Manhattan NY 10003.

Market Value of 450700. 11 rows City of Jersey City. City of Jersey City Tax Assessor.

1 deed found from 400000. Left to the county. 189 of home value.

The main function of the Tax Assessors Office is the appraisal and evaluation of. As ordered by the New Jersey Division of Taxation the City of Elizabeth is revaluing all taxable. For the past 4 years Ive been researching and writing about property taxes and.

Joseph Elliott 861 Asbury Avenue Room 107 Ocean City NJ 08226. Search Valuable Data On A Property. You can call the City of Jersey City Tax Assessors Office for assistance at 201-547-5132.

Jim Dolan reports on residents of Jersey City who could be hit with big tax hikes. The tax rate is set and certified by the. Start Your Homeowner Search Today.

Ad Get In-Depth Property Tax Data In Minutes. The Property Tax Assessor in Jersey City has been attempting to. Tax amount varies by county.

To view Jersey City Tax Rates and Ratios read. TO VIEW PROPERTY TAX ASSESSMENTS. The responsibilities of the City of Bayonnes tax assessor involve assessing.

Tax Collector S Office City Of Englewood Nj

Jersey City Property Tax Appeals A Civic Step By Step Overview Civic Parent

Property Taxes By State How High Are Property Taxes In Your State

Here Are The 30 N J Towns With The Lowest Property Tax Bills Nj Com

U S Cities With The Highest Property Taxes

2022 Property Taxes By State Report Propertyshark

50 Counties With The Highest Lowest Property Tax Assessments Cheapism Com

Property Tax Rates Average Tax Bills And Average Home Valuations In Hudson County New Jersey

Atlantic County Nj Property Property Tax Rates Average Tax Bills And Residential Assessments

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

New Jersey Education Aid Jersey City S Property Taxes Are State S Most Unfair Is Anyone Surprised

New Jersey 2022 Sales Tax Calculator Rate Lookup Tool Avalara

New Jersey Taxing Jurisdictions Engaging In Reverse Assessment Appeals Paradigm Tax Group

Best Cheap Homeowners Insurance In Jersey City Bankrate

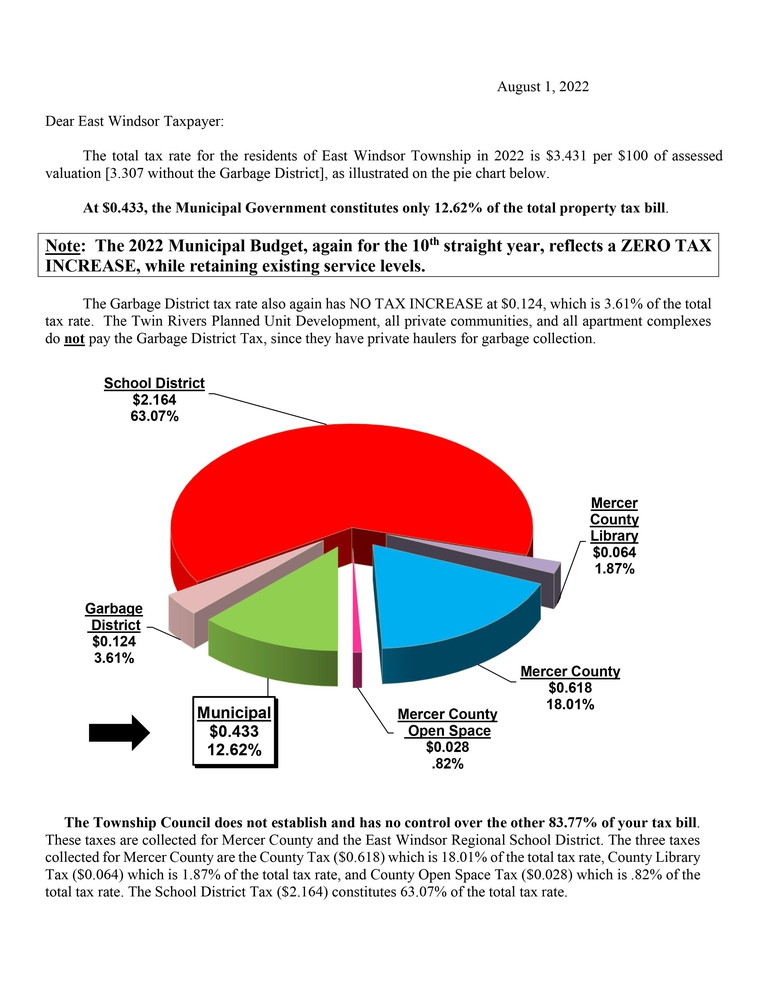

Official Website Of East Windsor Township New Jersey Tax Collector

How Do State And Local Property Taxes Work Tax Policy Center